NewERA

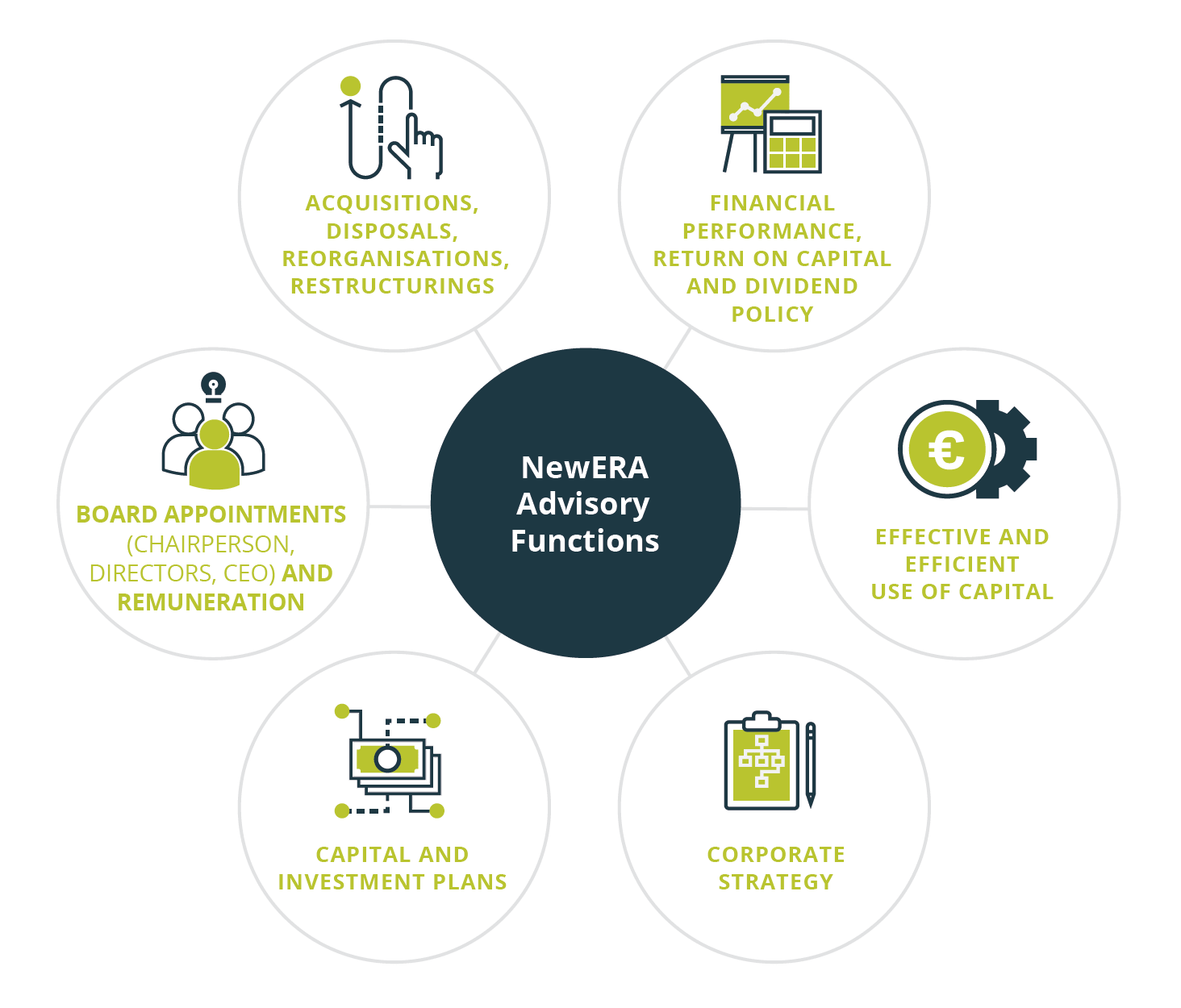

NewERA provides a dedicated centre of corporate finance expertise to Government, providing financial advice to Ministers regarding their shareholdings in major commercial State bodies.

Commercial and Financial Advice

During 2017, NewERA provided financial and commercial advice to Government on a range of items relating to the State bodies it oversees:

NewERA’s role continued to expand during 2017 and significant assignments were undertaken at the request of Government Ministers in relation to other State companies including:

Annual Portfolio Review

NewERA published its annual review of the commercial State bodies within its Portfolio, setting out the key challenges and opportunities relating to each body in December 2017.

NewERA’s core role is to provide financial and commercial advice to Government Ministers in relation to a number of major commercial State bodies: Bord na Móna, Coillte, EirGrid, Ervia (including Gas Networks Ireland), ESB and Irish Water (the Portfolio).

These companies play a critical role in the Irish economy, including through investment in enabling infrastructure in water and energy networks. Gross investment in the form of capital expenditure was €1.5bn in 2016/2017, with 60% of this on regulated network assets (water and energy) within the State. Substantial investment is expected to continue with up to €4bn projected to be invested in the regulated energy network infrastructure in the State over the period 2017-2021 while some €13bn has been estimated by Irish Water as the required investment in order to address all known deficits in water infrastructure. Project Ireland 2040 National Development Plan 2018-2027 also references the importance of the investment projected to be made by these bodies over the next decade.

Where specifically requested by the relevant Government Ministers, NewERA’s role also extends to other State companies or assets. As a dedicated centre of financial expertise, NewERA brings an additional commercial focus to the oversight of commercial State companies.

ACTIVE OWNERSHIP

A key aim of NewERA, working with Government Departments, is to enhance the State’s role as an active shareholder in the companies it owns, providing a framework for a clearer understanding of the State’s objectives and financial expectations for the companies.

To help achieve these objectives, NewERA has developed a Shareholder Expectations Framework (the Framework) to facilitate greater active ownership by the State as shareholder. The Framework’s purpose is to provide formal clarity and guidance to the boards of these bodies in relation to the Government’s strategic priorities, policy objectives, financial performance and reporting requirements.

These are communicated to the bodies through a “Shareholder Letter of Expectation” that is issued by the relevant Government Minister. Areas in the Shareholder Letter of Expectation which are of primary focus for NewERA from a financial and commercial perspective as at end 2017 are:

- Consistent measures of financial performance, tailored to each body;

- A requirement for the relevant bodies to prepare commercial equity valuations to facilitate the measurement of total shareholder return; and

- Development of formal financial targets that typically include a capital structure target, a profitability target and a dividend target.

CORPORATE FINANCE ADVISORY SERVICES

NewERA Portfolio

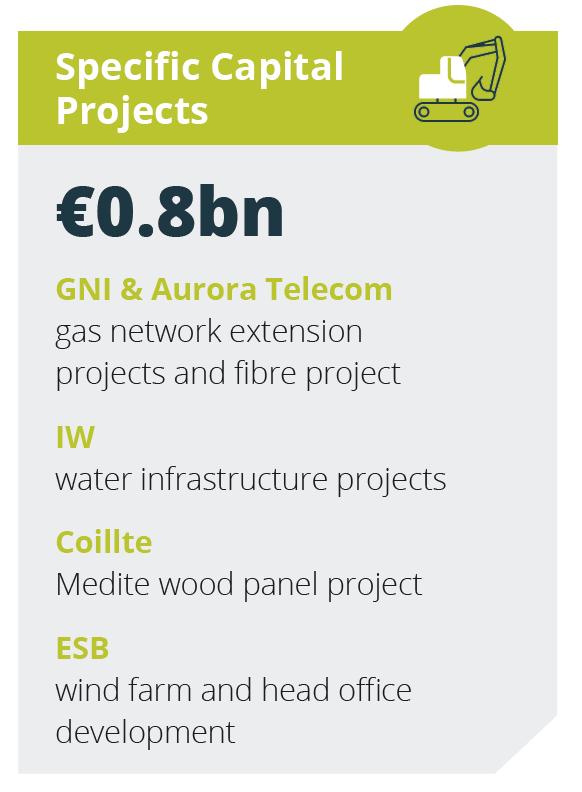

During 2017, NewERA provided detailed financial analysis and recommendations (where appropriate) to Government Ministers on a total of 70 submissions for Ministerial consideration and consent, made by the bodies within its core remit. This included €1.9bn in debt financing-related requests (including bond issuance and commercial debt facilities), €1.3bn in relation to capital expenditure budget requests and €0.8bn in specific capital expenditure project requests. NewERA also worked closely with the Public Appointments Service in carrying out its advisory role with regard to board appointments.

Additional State Companies

NewERA experienced continued growth during 2017 in the number of assignments it was requested to undertake by Government Ministers in relation to a broad range of other State companies. Ongoing financial and commercial advice was provided on the main commercial State companies in the transport sector following an agreement put in place during 2017 with the Department of Transport, Tourism and Sport.

Selected NewERA Assignments 2017: Additional State Companies

| Project | Description |

|---|---|

|

|

Financial review and analysis of strategic and funding plan and assistance/advice provided to relevant Ministers regarding a State loan to An Post. |

|

|

Financial review and analysis of business plans of CIÉ, Bus Éireann and Irish Rail. Financial review of financing facilities of CIÉ. |

|

|

Financial review on behalf of DTTAS and DPER in context of a revised dividend policy given Dublin Port’s major capital investment plans. |

|

|

Advice to DTTAS and DPER on a revised dividend policy. |

|

|

Financial analysis and advice to Minister for Health in relation to a review of Vhi’s strategic and financial plan. |

|

|

Financial review and analysis of the financing structure of the Ringaskiddy redevelopment project. |

| Note: DTTAS: Department of Transport, Tourism and Sport, DPER: Department of Public Expenditure and Reform. | |

Additional Corporate Finance Assignments

There was continued growth during 2017 in the number of corporate finance advisory assignments carried out by NewERA on behalf of Government Ministers across a wide range of sectors.

Selected NewERA Assignments 2017: Additional Projects

| Project | NewERA's Role |

|---|---|

|

|

CLIMATE ACTION AND RENEWABLE ENERGYProvided reviews from a financial perspective of the financial modelling developed by relevant Government Departments and agencies for climate action measures for the National Mitigation Plan that was published in July 2017. Also participated in projects including support scheme for renewable heat, renewable electricity support scheme and assessment of costs and benefits of biogas and biomethane. |

|

|

ENERGY EFFICIENCYProvided financial assistance and advice in relation to a cost benefit analysis and financial structuring regarding a public lighting project. If successful, this project could reduce the energy and maintenance costs associated with the public lighting network by more than 50% and enable local authorities to meet their 2020 energy efficiency targets in full. |

|

|

FORESTRYNewERA took part in initiatives under the Government's Forestry Programme aimed at increasing investment in the sector including peatland afforestation. |

|

|

RUGBY WORLD CUP 2023 BIDProvided specialist financial and commercial assistance to Government Departments in relation to certain aspects of the State's support of the bid to host Rugby World Cup 2023. |

|

|

MID REVIEW OF CAPITAL PLAN/NATIONAL DEVELOPMENT PLANProvided assistance and input on the contribution of the commercial State sector to investment under these plans. |

NEWERA ANNUAL FINANCIAL REVIEW 2016/2017

NewERA published its Annual Financial Review of the commercial State bodies within its core remit in December 2017. This is available at ntma.ie/publications. The Review sets out key financial information and metrics both for the Portfolio as a whole and for each individual body.

In the context of the strategic, business and financial plans of each of the bodies, the Review also comments on a number of themes of relevance from a shareholder perspective including:

- Brexit and its possible impact on the energy sector, given the concentration of the Portfolio bodies operating in the energy sector, the range of Portfolio investments in the UK, and the extent of the Portfolio’s bilateral trade with the UK;

- The delivery of investment and transformation plans for Irish Water;

- Ireland’s transition to a low-carbon energy system and the role of commercial State bodies (the first National Mitigation Plan was published by the Minister for Communications, Climate Action and Environment in July 2017 and the commercial State sector has a key role to play in relation to many of the measures set out in this plan which are cross sectoral and long term in nature); and

- The Review notes that it might be helpful for the State to develop an overarching framework of principles or the ownership of and investment by State bodies.

The Review also sets out key challenges and opportunities relating to each body which gives an indication of the complex environments in which the bodies operate.

NewERA Portfolio Companies: Overview of Key Challenges and Opportunities

|

|

Bord na Móna

|

|

|

|

Coillte

|

|

|

|

Eirgrid Group

|

|

|

|

ervia - Gas Networks Ireland

|

|

|

|

ervia - Uisce Éireann

|

|

|

|

ESB - Energy for generations

|

|

Financial Information

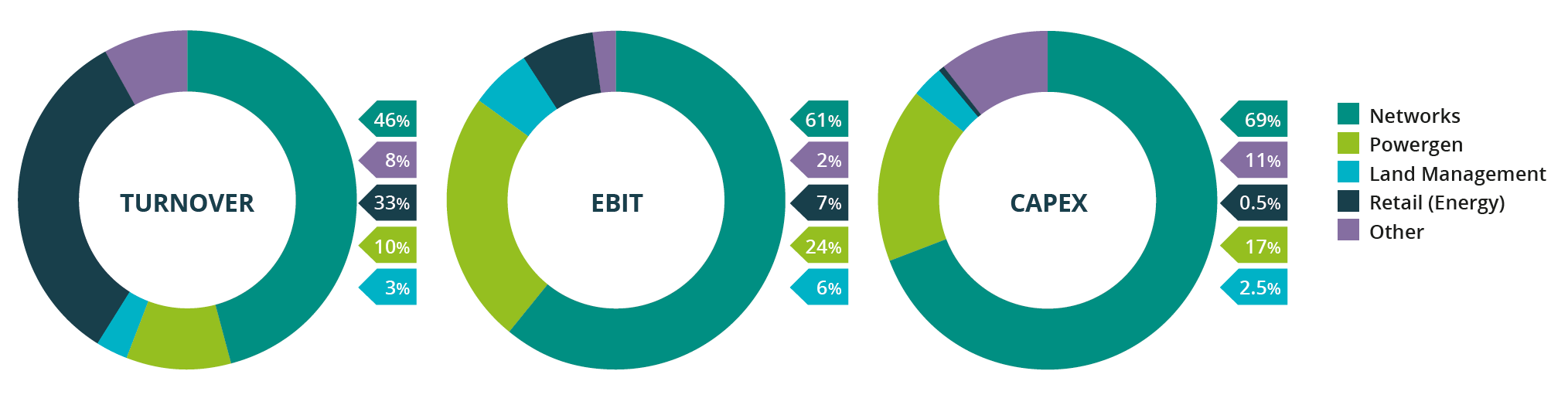

In 2016/17, the combined adjusted operating profitability of the Portfolio decreased slightly to €994m from €1,044m in 2015/16, reflecting underlying turnover decline coupled with increased depreciation charges. A significant proportion of operating profit continues to be derived from the Portfolio’s regulated electricity and gas networks (2016/17: 64%, 2015/16: 58%) and power generation assets (2016/17: 25%, 2015/16: 24%).

Return on Invested Capital (ROIC) decreased from 6.1% in 2015/2016 to 5.6% in 2016/17, indicative of the underlying decrease in the profitability of the Portfolio. However, this return is reasonable at Portfolio level given the challenges in some of the underlying businesses. The net gearing of the Portfolio decreased from 53% in 2015/16 to 50% in 2016/17. Total dividends of €236m were paid, of which €232m was to the Exchequer, compared to €441m paid in 2015/16. This was due to a reduction in special dividends paid, with normal dividends paid in 2016/17 of €136m (an increase of €9m on 2015/16).

Portfolio – Financial Highlights

| 2016/17 | 2015/16 | yoy Δ | 5yr. avg. | |

|---|---|---|---|---|

| KEY FINANCIAL INFORMATION | €m | €m | €m | €m |

| Turnover | 5,982 | 6,100 | (117) | 5,885 |

| Operating Profit | 994 | 1,044 | (50) | 951 |

| PAT (adjusted) | 615 | 625 | (10) | 547 |

| Pension Liabilities | 1,029 | 1,009 | 21 | 1,123 |

| Net Debt | 6,989 | 7,421 | (432) | 6,864 |

| Net Assets | 6,905 | 6,631 | 274 | 6,731 |

| Invested Capital | 16,032 | 15,535 | 497 | 15,505 |

| Gross Capex | 1,498 | 1,572 | (73) | 1,448 |

| Dividends Paid (total) | 236 | 441 | (205) | 292 |

| Commercial Equity Valuation | 10,126 | 10,169 | (43) | n/a |

| KEY METRICS | % | % | % | % |

| Operating Profit Margin | 16.6 | 17.1 | (0.5) | 16.2 |

| PAT margin | 10.3 | 10.2 | 0.0 | 9.3 |

| ROIC | 5.6 | 6.1 | (0.5) | 5.4 |

| Net Gearing | 50.3 | 52.8 | (2.5) | 50.5 |

| Source: Annual Reports, NewERA Analysis | ||||

Financials by Activity

- Source: NewERA Analysis