Statistics

Composition of Debt

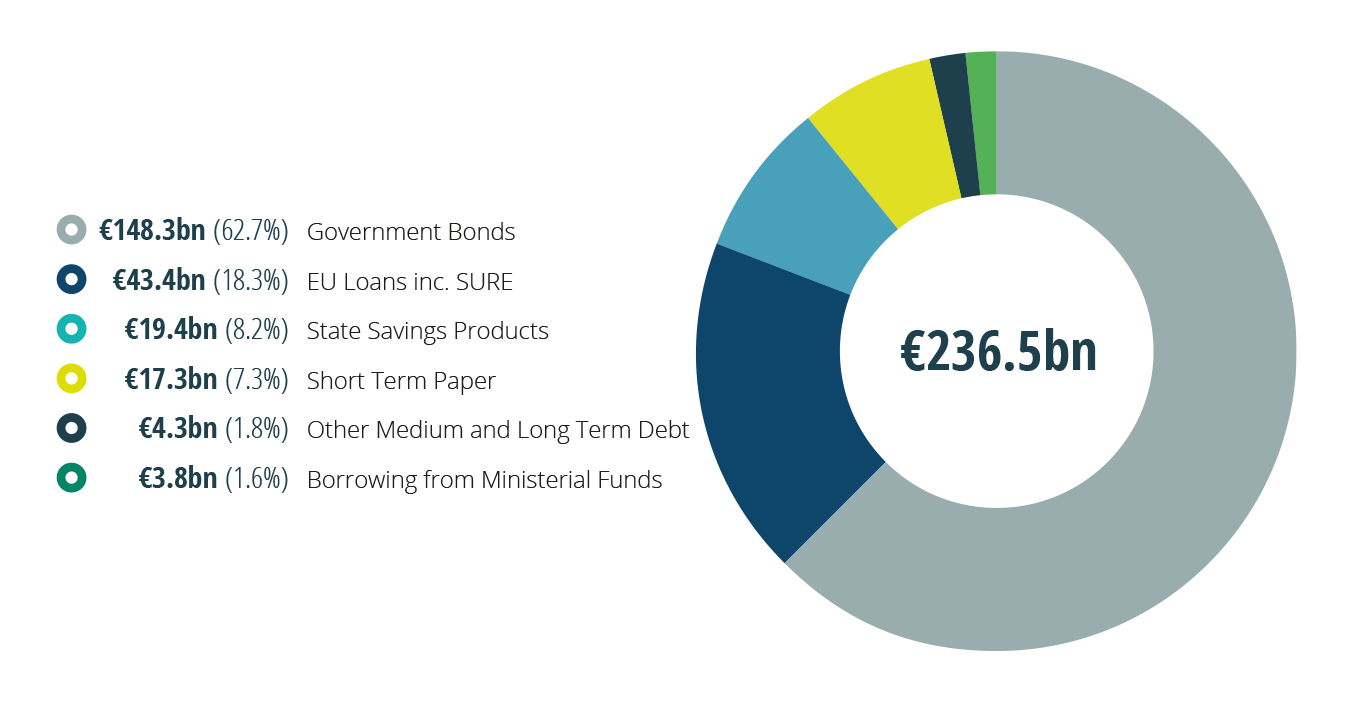

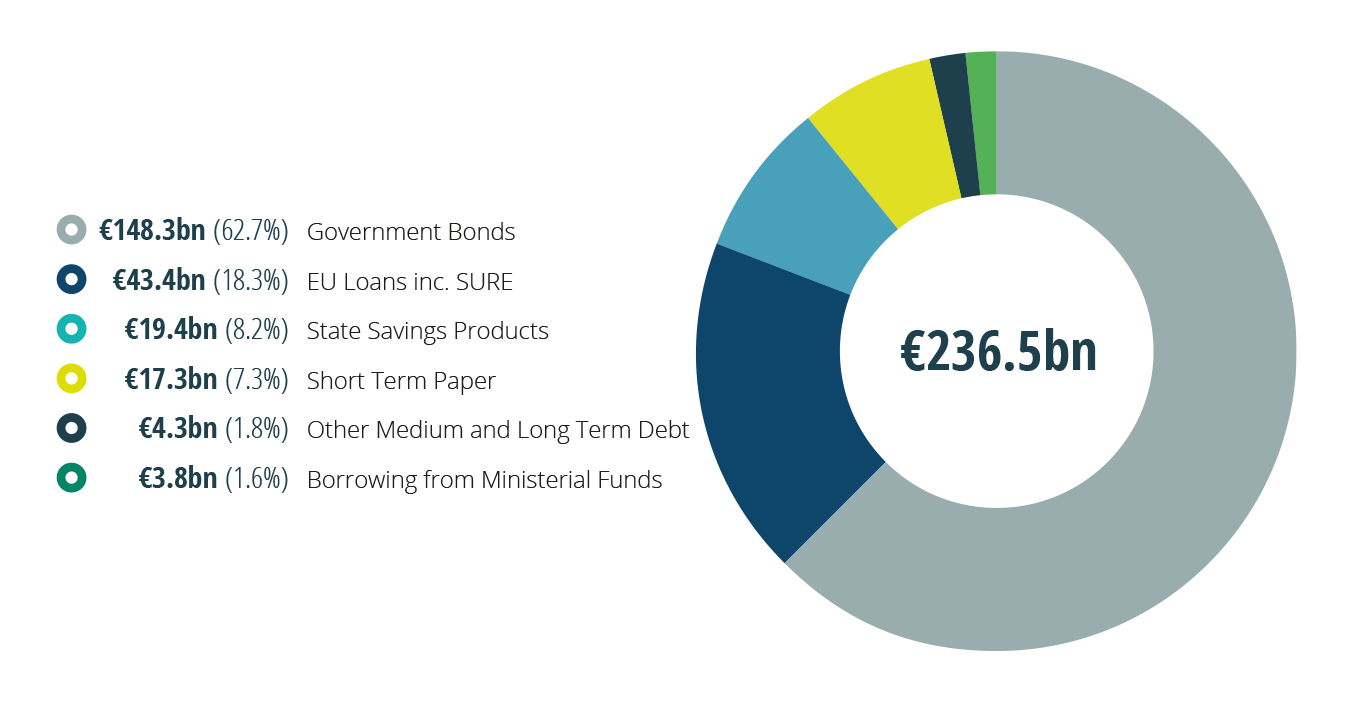

Gross National Debt at End-May 2021

| Composition of Debt at End-May 2021 | €bn | Movement from |

|---|---|---|

| Government Bonds* | 148.3 | 11.5 |

| Fixed Rate Treasury Bonds | 140.4 | 12.4 |

| Floating Rate Bonds | 6.5 | -1.0 |

| Amortising Bonds | 0.4 | 0.0 |

| Inflation-Linked Bonds | 1.0 | 0.1 |

| EU Loans inc. SURE | 43.4 | 2.0 |

| European Financial Stabilisation Mechanism (EFSM) | 22.5 | 0.0 |

| European Financial Stability Facility (EFSF) | 18.4 | 0.0 |

| UK Bilateral Loan | 0.0 | -0.5 |

| SURE Programme Loan | 2.5 | 2.5 |

| State Savings Products** | 19.4 | 0.5 |

| Fixed Rate Products | 15.1 | 0.3 |

| Prize Bonds | 4.3 | 0.2 |

| Short Term Paper | 17.3 | 3.2 |

| Marketable (Commercial Paper and Treasury Bills) | 10.5 | 1.9 |

| Non-Marketable (Exchequer and Central Treasury Notes) | 6.8 | 1.4 |

| Other Medium and Long Term Debt | 4.3 | 0.2 |

| European Investment Bank & Council of Europe Development Bank Loans | 1.5 | 0.0 |

| Private Placements & Medium-Term Notes | 2.9 | 0.2 |

| Borrowing from Ministerial Funds | 3.8 | -0.5 |

| Gross National Debt | 236.5 | 17.0 |

| Cash and Liquid Assets | 28.0 | 10.6 |

| Other Non-Liquid Financial Assets | 1.8 | 0.0 |

| National Debt | 206.7 | 6.4 |

Notes:

Rounding may affect totals. National Debt figures for 2020/2021 are unaudited.

*Government Bonds includes NTMA repo activity.

**State Savings Schemes also include Post Office Savings Bank (POSB) deposits. While not an explicit component of the National Debt, these funds are mainly lent to the Exchequer as a ways and means of funding short-term Exchequer requirements. Taking into account the POSB Deposits, total State Savings outstanding were €23.5 billion at end-May 2021.

Source: NTMA

| Composition of Debt at End-December 2020 | €bn | General Government Debt €bn |

|---|---|---|

| Government Bonds* | 136.8 | |

| Fixed Rate Treasury Bonds | 127.9 | |

| Floating Rate Bonds | 7.5 | |

| Amortising Bonds | 0.4 | |

| Inflation-Linked Bonds | 0.9 | |

| EU/UK Bilateral Loans | 41.4 | |

| European Financial Stabilisation Mechanism (EFSM) | 22.5 | |

| European Financial Stability Facility (EFSF) | 18.4 | |

| UK Bilateral Loan | 0.5 | |

| State Savings Products** | 18.8 | |

| Fixed Rate Products | 14.7 | |

| Prize Bonds | 4.1 | |

| Short Term Paper | 14.0 | |

| Marketable (Commercial Paper and Treasury Bills) | 8.6 | |

| Non-Marketable (Exchequer and Central Treasury Notes) | 5.4 | |

| Other Medium and Long Term Debt | 4.1 | |

| European Investment Bank & Council of Europe Development Bank Loans | 1.5 | |

| Private Placements & Medium-Term Notes | 2.6 | |

| Borrowing from Ministerial Funds | 4.3 | |

| Gross National Debt | 219.5 | 219.5 |

| Cash and Liquid Assets | 17.4 | |

| Other Non-Liquid Financial Assets | 1.8 | |

| National Debt | 200.3 | |

| General Government Debt adjustments | -1.3 | |

| General Government Debt | 218.2 |

Notes:

Rounding may affect totals. National Debt figures for 2020 are unaudited. The figures take account of the effect of currency hedging transactions.

*Government Bonds includes NTMA repo activity.

**State Savings Schemes also include Post Office Savings Bank (POSB) deposits. While not an explicit component of the National Debt, these funds are mainly lent to the Exchequer as a ways and means of funding short-term Exchequer requirements. Taking into account the POSB Deposits, total State Savings outstanding were €22.7 billion at end-December 2020.

Source: NTMA

General Government Debt (GGD) is a measure of the total gross consolidated debt of the State compiled by the Central Statistics Office (CSO) and is the measure used for comparative purposes across the European Union. The National Debt is the net debt incurred by the Exchequer after taking account of cash balances and other financial assets. Gross National Debt is the principal component of GGD. GGD also includes the debt of central and local government bodies. GGD is reported on a gross basis and does not net off outstanding cash balances and other related assets – unlike the National Debt. The CSO report that GGD at end-2020 stood at €218.2 billion or 59.5% of Gross Domestic Product (GDP).

The CSO produces a measure of General Government Net Debt by subtracting from the General Government Gross Debt figure the value of the financial assets corresponding to the categories of financial liabilities which comprise General Government Gross Debt. The CSO report that at end-2020 General Government Net Debt stood at €187.7 billion or 51.2% of GDP.

CSO Government Finance Statistics Annual - April 2021 Results

The figures in this section relate to GGD and National Debt. However, it should be noted that the NTMA's responsibilities relate to National Debt only.

| National Debt €bn | General Government Debt €bn | |

|---|---|---|

| Government Bonds* | 130.1 | |

| EU & UK Bilateral Loans | 43.3 | |

| State Savings Products** | 17.8 | |

| Short Term Paper | 10.0 | |

| Other Medium and Long Term Debt | 2.6 | |

| Borrowing from Ministerial Funds | 3.0 | |

| Gross National Debt | 206.7 | 206.7 |

| Cash and Liquid Assets | 16.5 | |

| Other Non-Liquid Financial Assets | 2.0 | |

| National Debt | 188.2 | |

| General Government Debt adjustments | -2.5 | |

| General Government Debt | 204.2 |

Rounding may affect totals. The figures take account of the effect of currency hedging transactions.

*Government Bonds includes NTMA repo activity.

**State Savings Schemes also include Post Office Savings Bank (POSB) deposits. While not an explicit component of the National Debt, these funds are mainly lent to the Exchequer as a ways and means of funding short-term Exchequer requirements. Taking into account the POSB Deposits, total State Savings outstanding were €21.2 billion at end-December 2019.

Source: NTMA and Central Statistics Office (CSO) General Government Debt