Short-term Instruments

The NTMA’s short-term debt programme, comprising Treasury Bills, Commercial Paper and Exchequer Notes, provides liquidity and flexibility in the timing of long-term funding operations.

Please contact the cashdesk team (email: cashdesk@ntma.ie, tel: +353 1 238 4725 and +353 1 238 4748 ) with queries concerning short-term paper.

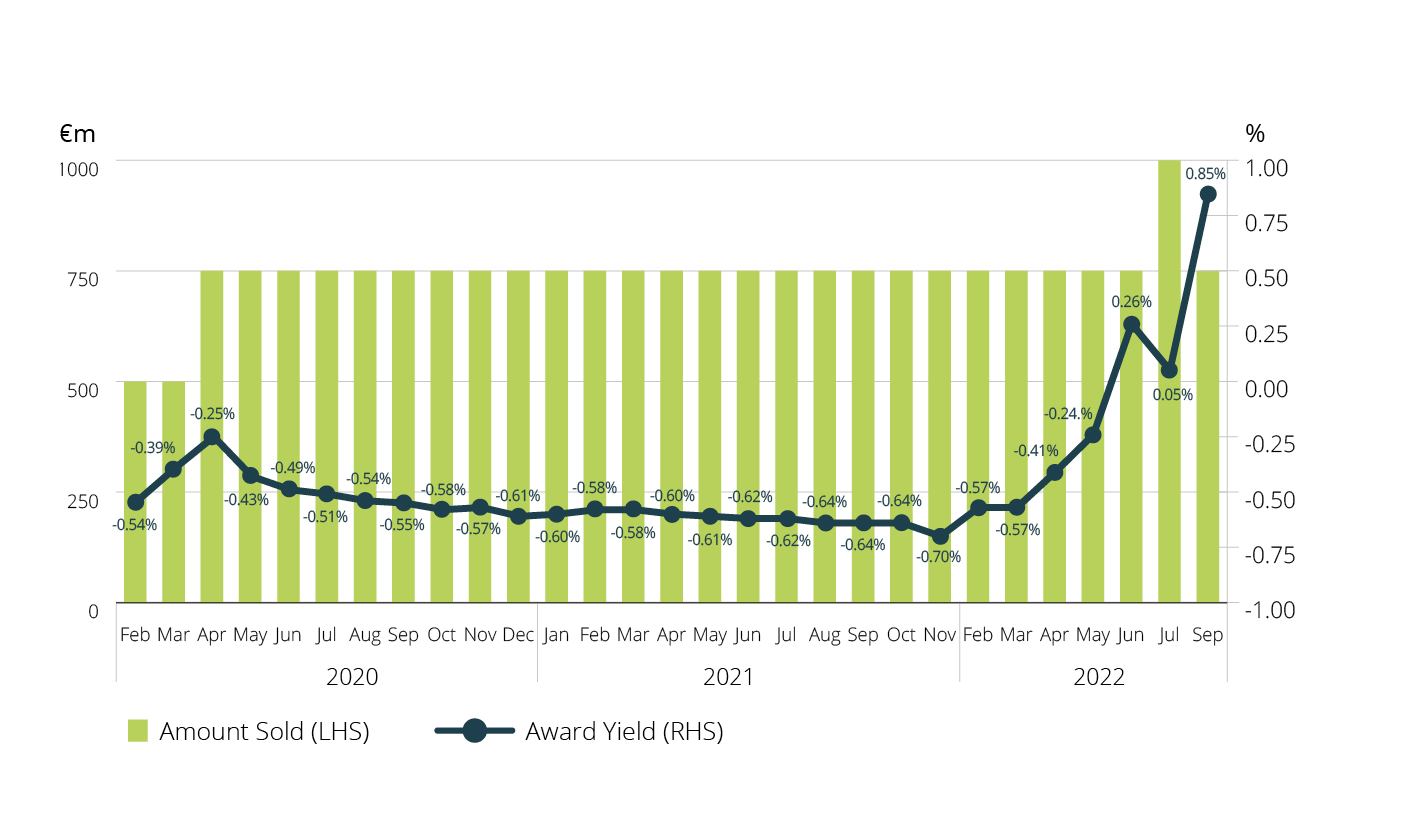

Treasury Bills

Irish Treasury Bills are zero coupon instruments which normally have maturities at issue of between one and twelve months. The main features of Irish Treasury Bills are set out in the NTMA’s Irish Treasury Bills Information Memorandum (249 KB, PDF format)